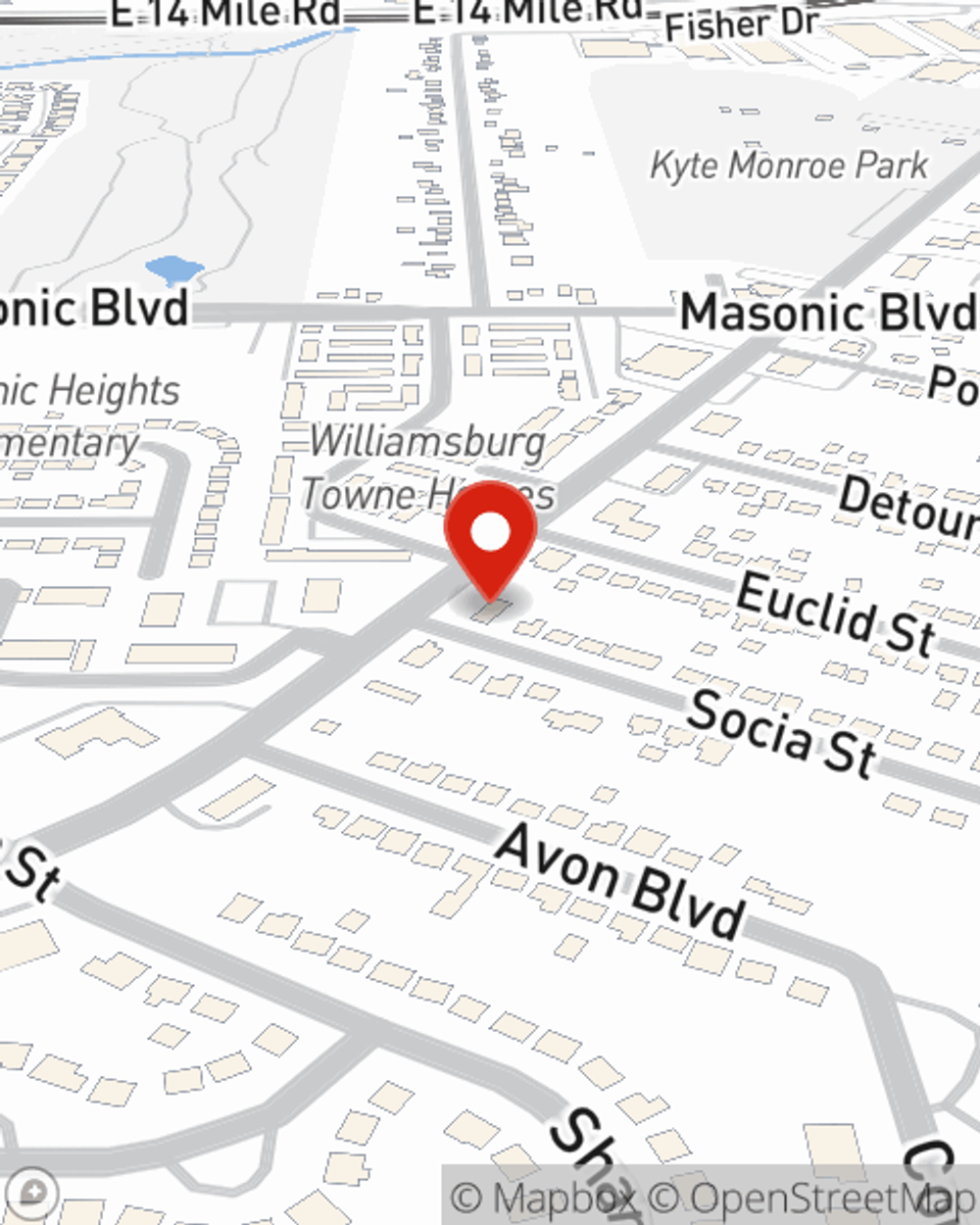

Homeowners Insurance in and around St Clair Shores

Homeowners of St Clair Shores, State Farm has you covered

Help cover your home

Would you like to create a personalized homeowners quote?

Welcome Home, With State Farm Insurance

Homeownership is a lot of responsibility. You want to make sure your home and the possessions in it are protected in the event of some unexpected mishap or loss. And you also want to be sure you have liability insurance in case someone stumbles and falls on your property.

Homeowners of St Clair Shores, State Farm has you covered

Help cover your home

Why Homeowners In St Clair Shores Choose State Farm

Preparing for life's troubles is made easy with State Farm. Here you can build the right plan or file a claim with the help of agent Sue Crowe. Sue Crowe will make sure you get the thoughtful, high-quality care that you and your home needs.

Now that you're convinced that State Farm homeowners insurance should be your next move, contact Sue Crowe today to learn more!

Have More Questions About Homeowners Insurance?

Call Sue at (586) 296-3800 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.

Simple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.